Hong Kong tourism numbers continue to rise - Colliers

Contact

Hong Kong tourism numbers continue to rise - Colliers

The first half of 2024 brought 21.15 million visitors to the Hong Kong SAR, up 64% from the same period in H1 2023, with an average of 116,000 visitors daily. Hong Kong hosted 25 million visitors from January to July, up 52% year-on-year (YoY) says Colliers.

The first half of 2024 brought 21.15 million visitors to the Hong Kong SAR, up 64% from the same period in H1 2023, with an average of 116,000 visitors daily. Some 16.5 million visitors were from the Mainland and 5 million were from overseas. Almost half of the visitors, 10.5 million, opted to spend the night in the city, with an average length of stay (ALOS) of 3.2 days. Hong Kong hosted 25 million visitors from January to July, up 52% year-on-year (YoY).

Meanwhile, the Hong Kong Tourism Board (HKTB) laid on a raft of events with the aim of boosting inbound visitors. The Doraemon Exhibition in July was a great success, attracting 5 million fans and bumping the hosting mall's food and beverage takings by 30%.

While H1 2024 inbound visitor numbers showed strong positive growth YoY, they were still some way off H1 2018's highs of 30.6 million, of which 13.856 million were overnight visitors.

The Meetings, Incentives, Conferences and Exhibitions (MICE) segment racked up 703,076 overnight arrivals from January to June, accounting for 7% of the overnight market share. The total comprised 346,883 (49.3%) from the Mainland, 129,106 (18.4%) from Long Haul Markets and 227,287 (32.3%) from Short Haul Markets.

Hotel performance eases despite year's strong start

"The robust tourism numbers have not translated into improved performance for the hotel and wider hospitality sector."

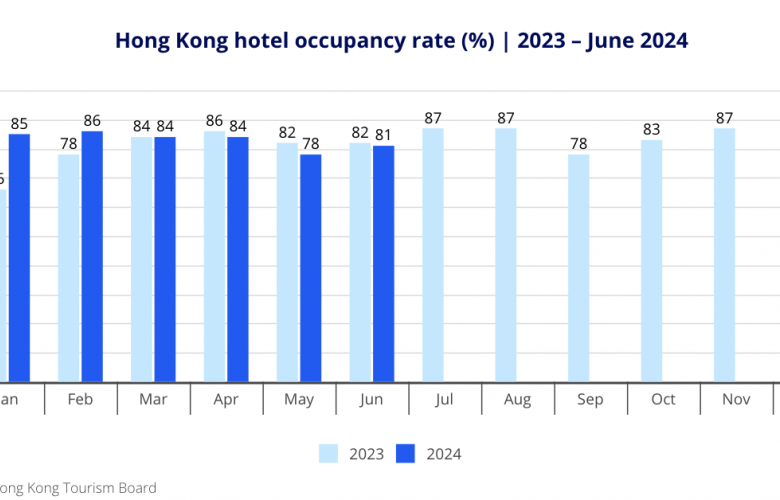

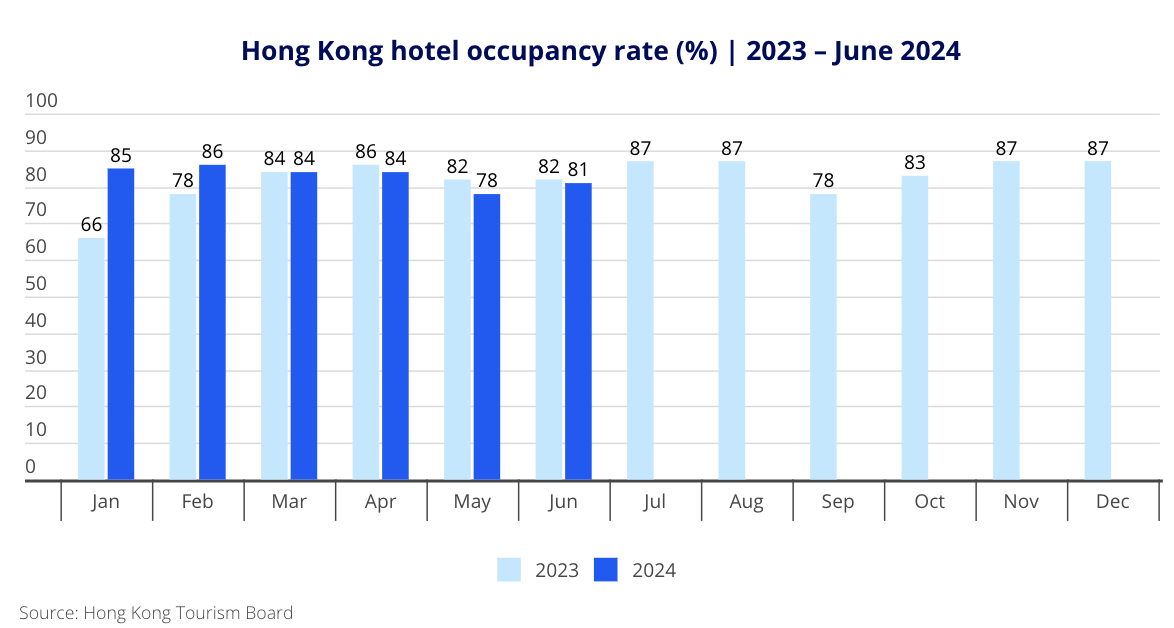

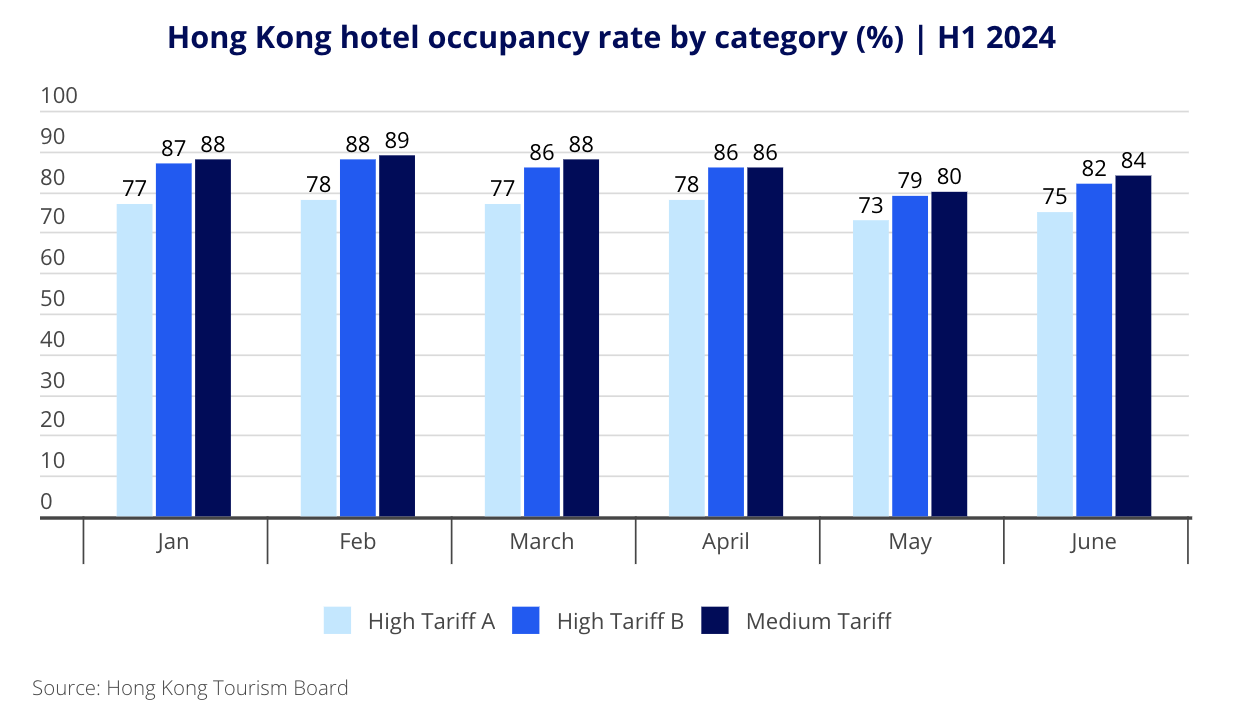

Despite the more robust tourism numbers, the hotel sector has not enjoyed a similar boost, giving up some of Q1's early optimism. January and February were relatively strong, with average occupancy (OCC) at 85% and 86%, respectively.

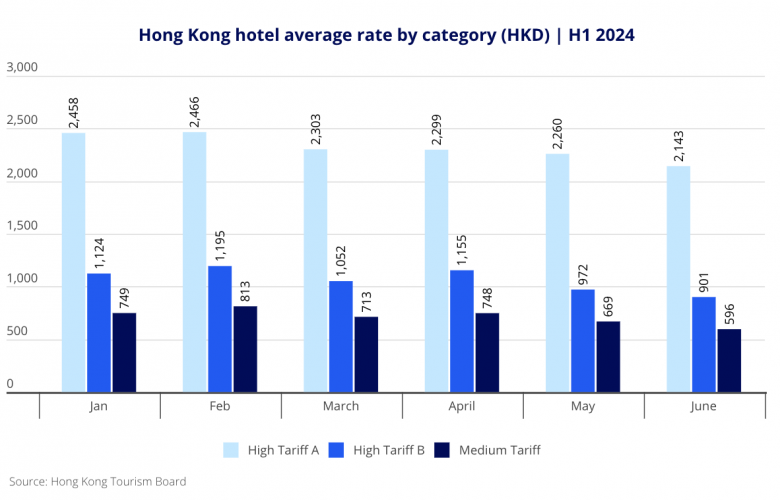

Average Daily Rate (ADR) for those months reached HKD 1,444 and HKD1,492. However, since then, the market has begun to slow slightly. Thus, OCC ended the first half of the year at 83%, with ADR at HKD 1,368, slightly up from H1 2023. Revenue Per Available Room (RevPar) averaged HKD 1,135 for the half against HKD 1,039 in the first half of 2023.

While average rates for H1 were up 5.3% year-on-year, the reality is that these figures were heavily skewed by the significant 30% increase experienced in the first two months of the year versus the same period in 2023 as the city opened up post-pandemic.

From March to June 2024, ADR slipped around 5% to 8% YoY and has pulled back nearly 20% from January and February's elevation. The market continues to attract more experience-driven, budget-conscious travellers, which directly impacts rates, while occupancy has also dipped modestly for most.

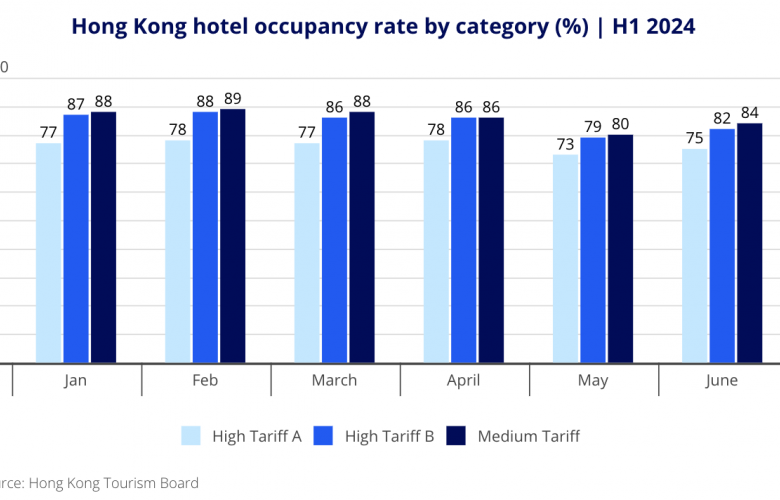

Data from the tourism board combines the luxury and upscale/upper-upscale sectors under the same 'High Tariff A' bracket. However, there is a performance difference between these segments, where occupancy and rates can vary significantly.

High Tariff A's average H1 occupancy was 76%. In contrast, the pure luxury sector continues to lag, with occupancies around 40% to 70% depending on the hotel, albeit while trying to maintain higher rates. Other hotel categories have also experienced modest easing.

Average rates generally drifted downward from April to June across all the main hotel tariff types. In June, 'High Tariff B' and 'Medium Tariff' rates ebbed by 11% and 12 %, respectively, compared to the same period last year.

Real Capital Analytic’s (RCA) data shows Asia Pacific’s (APAC) H1 2024 hotel transactions surpassed USD 7 billion, up 21% YoY. In Hong Kong, three noteworthy transactions reflected a total deal value of HKD 1.54 billion (c. USD 198 million), or 2.8% of APAC's total and roughly 15% of Hong Kong's foremost real estate investment transactions.

Private equity fund PGIM and Dash Living acquired The Sheung Wan by Ovolo for HKD 320 million. It is now the Dash Living on Queens. Hong Kong Metropolitan University acquired the newly developed 255-key Urbanwood Hung Hom Hotel for HKD 1 billion.

It will be operated as student accommodation offering 400+ beds. Crystal Investment acquired The Hotel Ease Access in Lai Chi Kok to tap into the tourism recovery story while potentially targeting students.

In July, the 63-key Popway Hotel in Tsim Sha Tsui was sold for HKD 180 million, just HKD 7,331 per square foot. The hotel boasts a gross floor average of 24,551 sq. ft. and had an initial guidance of closer to HKD 320 million earlier in the year.

The new owners will likely reposition the hotel to target students, given its proximity to The Hong Kong Polytechnic University.

"We continue to see a trend of under-performing hotels being acquired for conversion to student accommodation to offset the sector's strong demand and low supply, especially in light of the government's announcement on doubling the quota of non-local students from 20% to 40% for the city's universities."

Investment sentiment is cautious, yet certain investors have ample dry powder. All eyes are on the US Federal Reserve as it appears to be heading towards rate cut.

"Where pricing aligns with risk-adjusted returns and strategic objectives, we are seeing transactions. These typically involve 'stressed' or 'distressed' assets. The bid-ask spread remains wide but has narrowed significantly."

High interest rates make it challenging for many owners and operators to service their debt obligations, resulting in downward pricing pressure. Some of that pricing pressure may ease slightly as and when interest rates trend down, although that may still take time to filter through.

The financial secretary has asked banks to provide more support for SMEs to stave off receivership sales, with the Hong Kong Monetary Authority establishing a task force to this end. However, certain hotel and non-hotel deals are heading in that direction as pressure to reduce the debt burden increases.

Investors ultimately do not want to be negatively geared – whereby the Net Operating Income (NOI) remains insufficient to cover the cost of debt. Deals are proving difficult for private equity funds to underwrite, where leverage is often critical to hitting their internal rate of return (IRR) and equity multiple targets.

Access to debt from mainstream banks is essentially non-existent as they seek to clear some non-performing loans (NPLs). As a result, more investors and funds are looking at the distressed or credit space.

Cash-rich investors hold the cards in this market, as ample capital remains in the system to acquire rarely traded assets or take advantage of any pricing dislocation. In the current market decision-makers feel little pressure to deploy, so unless a deal makes sense, it may not transact.

Increasing operational costs have tightened margins and affected underwriting and return projections, while impacting operators’ bottom-line.

Moving forward

The hotel sector expected a swifter return to pre-pandemic levels, but in reality, the market has shifted.

"While historic performance is an essential reference point, the hotel sector now operates in a very different environment, with different demand drivers and expectations and a different set of challenges and opportunities."

Operationally, the lack of staff and the resultant increase in employees' pay and other costs are impacting margins. Hoteliers are working hard to curate the best packages to attract guests, and the city is pushing to elevate its position as Asia's leading city for business and leisure.

As we enter the final third of the year, good cheer will likely uplift hotel performance as traditional holidays, festivals, conferences, and events take centre stage.

These include the Mid-Autumn Festival, October Golden Week, the National Day Holiday, and others like the Global International Hotel Investment Forum Asia (IHIF Asia), Asia Financial Leaders' Summit, Clockenflap, HK Fashion Week, Shi Fu Miz Festival, Olivia Rodrigo, Ne-Yo, Lany, Anne-Marie and the Longines International horse racing.

Hong Kong is also home to some of Asia’s best bars, with four bars placed in the recent top ten listing, with the city’s Bar Leone taking the crown. Perhaps this will entice some additional overnight spending.

The Hong Kong Tourism Board (HKTB) will continue its drone shows and pyrotechnic displays to align with major festivals and events to enhance visitors' experience and encourage residents to enjoy the shows.

Investment-wise, with several assets on the market, we expect to see more hotel transactions as pricing expectations adjust in the current environment.

The F&B and retail sectors remain fragile, as inbound visitors spend less, and locals tend to travel outbound at weekends. The Mainland is not as strong a base market as it used to be, and the swelling tourism numbers need to translate into improved performance and increased spending all round.

Increased attention to widening the city's international source markets is underway, which may help boost performance over the mid-to-long term.

An improved schedule of world class international sporting events, concerts, and other attractions would enable hoteliers to plan better and curate packages and synergies with the broader industry and across the Greater Bay Area (GBA). The ability to attract top international acts and perhaps establish a residency for performers over an extended period may attract more visitors from around the world.

A more collaborative effort with a key statement of intent is needed to define and refine Hong Kong’s positioning and unlock the city’s potential. Perhaps Hong Kong SAR’s Chief Executive’s latest push for the new Kai Tak Stadium to be ready in early 2025, coupled with the recent news on Coldplay potentially performing there in can pave the way for what this amazing city has to offer.